by _strange_ » Sat Sep 30, 2023 4:19 am

During the summer doldrums a few months ago, I thought I had a decent understanding the market. Then one week I had 4 trades where the market was trending and I took a second entry at the top/bottom with room to the high/lows (happened both ways) and the market moved 1 single tick and filled my order and then completely reversed. A total reversal and never came back. I was so pissed off I had convinced myself that the market was tricking people in letting buyers pile up and then shoving the market the opposite way, and if thats how the markets work where the institutions somehow know this and are targeting people, how can anyone possibly trade a rigged game where big money has all the cards and kills the little guy? I was convinced this was all intentional and that I was following all the rules and it wasnt my fault. I then sobered up from my frustration and set out to try and workout what my mistake was, and clearly it wasnt the market tricking people, it was me not following the rules and not noticing these massive reactive areas. I still think the markets are trapping and baiting but not at the scale I had convinced myself of. They are moving the markets and setting the price but there is a bit of a method to it as well it seems.

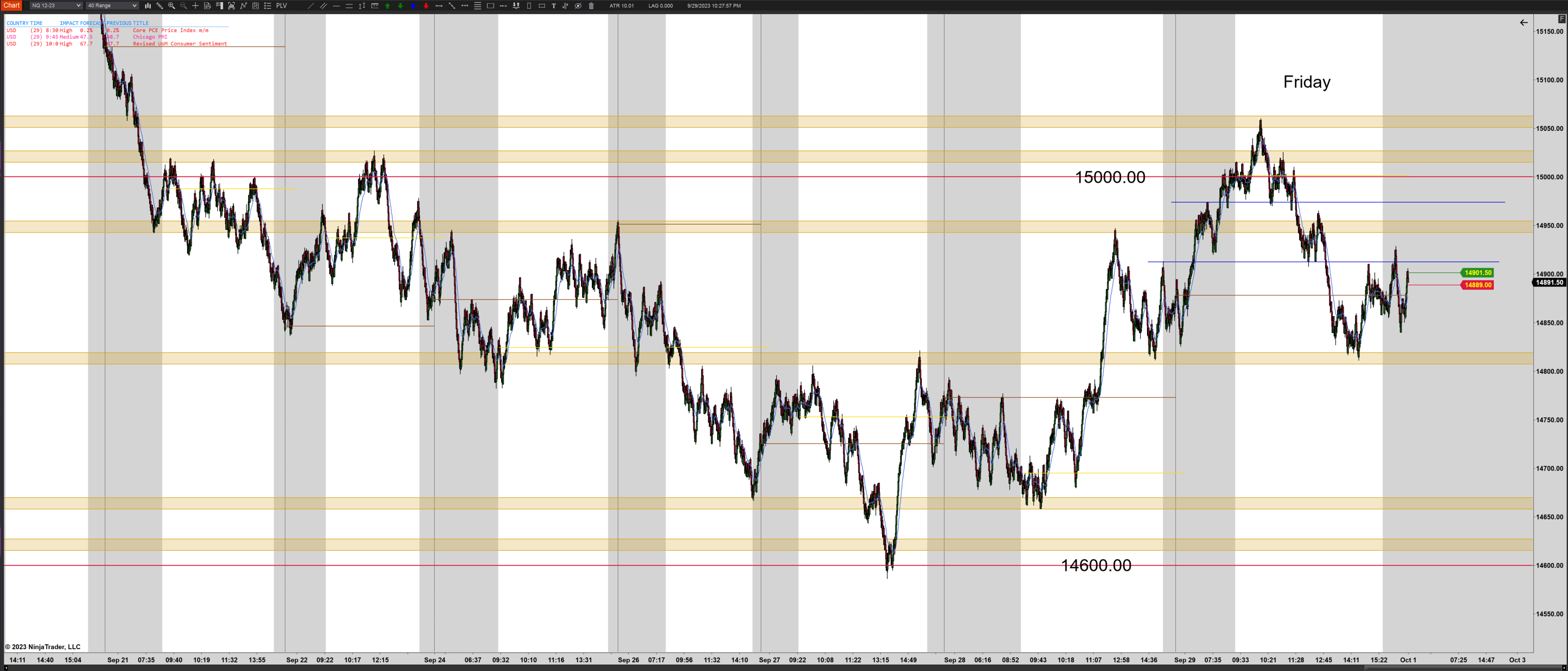

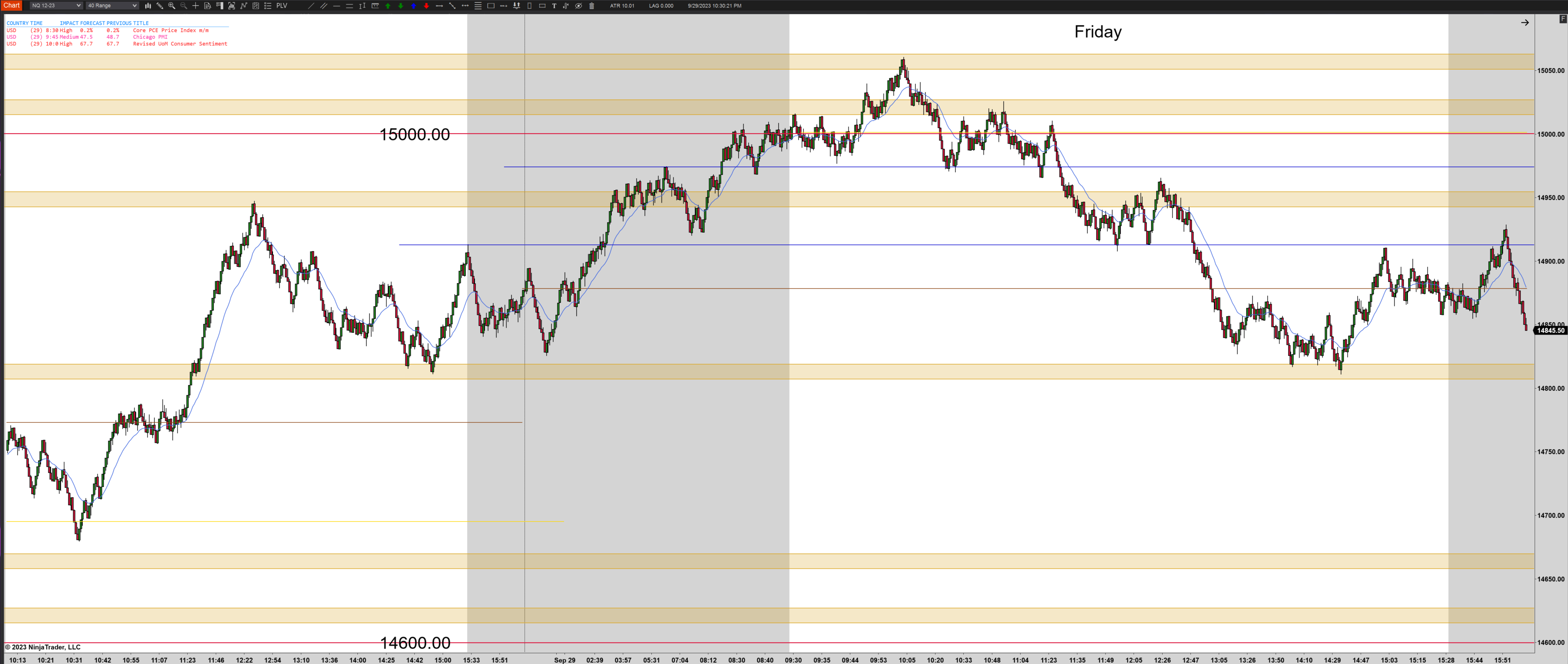

This is all to say that this process has had lots of light bulb moments and you can really map out whats going on and dont have to be completely blind. Friday, I had charted out in gold major areas of support/resistance, and low and behold the day played out fighting out those areas. The red lines were price points and clearly 15000 was high enough for the day even though the market is oversold. But is 15000 the critical point or is it support turned resistance from 3 months ago? They both align almost perfectly. Odd.

Weirdly, and this happens alot, 15000 ended up being the median line of a range for a while. Why does this happen? its almost always equidistant on both sides of an important area. Weird because range median lines are often the critical point of the price action, we trade the outsides in but the fight is alot of the time over the middle. Market opened for the day at almost 15000 to the tick, odd.

Why is it when we have a trend, all of a sudden itll completely runaway, overshoot, bounce hard, overshoot the otherside, and maybe/maybe not get a retest? It might bounce and completely reverse, it might just overshoot the otherside and push down again? It seems like what happens is the market falls out of a support area and theres no other area nearby to fight over so everybody and their mother agrees and brings it to the next big area of importance, and everyone agrees when it gets to this next area that they are going to dogplie it the other way. Seems like most people are in agreement and everyone sees these big areas. I dont think there are "bulls" and "bears" because everyone is a bull AND a bear.

Second entries, 2 attempts, the rule of 2's etc.... This is what brings the probabilities up extremely high, its like the key to it all, but ONLY when you are already biased correctly, which is insanely difficult. Second entries are fantastic entries when you are certain of the direction, but just as good of an entry as they are if your bias is right, they are exceptional "traps" if your bias is wrong. Great if your right, but you dont stand a chance if youre wrong, at least with my trading anyway. When im wrong I dont even get lucky even occasionally, rarely even get a chance to get out at breakeven.

I think I "get it" well enough so far but every time I have felt this way, some other aspect shows itself and its back to the drawing board. Sometimes is soooooo easy to see after the fact, but in the moment its wildly difficult. Clearly the easiest and most reliable setups are second entries with the trend, but you can add layers to that too. Trading reversals isnt an important thing for me, but understanding them is. If you dont know when or why to be thinking reversal, when and why to change bias or keep an open mind about it, how can anyone keep their probabilities high enough and consistent enough to make money?

Anyway im writing a novel here but I wanted to get these thoughts out for your feedback and direction. Not so much any direct question, more if my thoughts and observations are more "right" than they are "wrong" so I can stay on the right path. The attached charts are without trendlines etc from the day, but as the trading day goes on they get quite busy and noisy so ive been trying to workout the cleanest way to keep up with the important stuff without having a messy chart thats hard to follow.

- Screenshot 2023-09-29 222804.png (610.48 KiB) Viewed 5581 times

- Screenshot 2023-09-29 223026.png (379.91 KiB) Viewed 5581 times

During the summer doldrums a few months ago, I thought I had a decent understanding the market. Then one week I had 4 trades where the market was trending and I took a second entry at the top/bottom with room to the high/lows (happened both ways) and the market moved 1 single tick and filled my order and then completely reversed. A total reversal and never came back. I was so pissed off I had convinced myself that the market was tricking people in letting buyers pile up and then shoving the market the opposite way, and if thats how the markets work where the institutions somehow know this and are targeting people, how can anyone possibly trade a rigged game where big money has all the cards and kills the little guy? I was convinced this was all intentional and that I was following all the rules and it wasnt my fault. I then sobered up from my frustration and set out to try and workout what my mistake was, and clearly it wasnt the market tricking people, it was me not following the rules and not noticing these massive reactive areas. I still think the markets are trapping and baiting but not at the scale I had convinced myself of. They are moving the markets and setting the price but there is a bit of a method to it as well it seems.

This is all to say that this process has had lots of light bulb moments and you can really map out whats going on and dont have to be completely blind. Friday, I had charted out in gold major areas of support/resistance, and low and behold the day played out fighting out those areas. The red lines were price points and clearly 15000 was high enough for the day even though the market is oversold. But is 15000 the critical point or is it support turned resistance from 3 months ago? They both align almost perfectly. Odd.

Weirdly, and this happens alot, 15000 ended up being the median line of a range for a while. Why does this happen? its almost always equidistant on both sides of an important area. Weird because range median lines are often the critical point of the price action, we trade the outsides in but the fight is alot of the time over the middle. Market opened for the day at almost 15000 to the tick, odd.

Why is it when we have a trend, all of a sudden itll completely runaway, overshoot, bounce hard, overshoot the otherside, and maybe/maybe not get a retest? It might bounce and completely reverse, it might just overshoot the otherside and push down again? It seems like what happens is the market falls out of a support area and theres no other area nearby to fight over so everybody and their mother agrees and brings it to the next big area of importance, and everyone agrees when it gets to this next area that they are going to dogplie it the other way. Seems like most people are in agreement and everyone sees these big areas. I dont think there are "bulls" and "bears" because everyone is a bull AND a bear.

Second entries, 2 attempts, the rule of 2's etc.... This is what brings the probabilities up extremely high, its like the key to it all, but ONLY when you are already biased correctly, which is insanely difficult. Second entries are fantastic entries when you are certain of the direction, but just as good of an entry as they are if your bias is right, they are exceptional "traps" if your bias is wrong. Great if your right, but you dont stand a chance if youre wrong, at least with my trading anyway. When im wrong I dont even get lucky even occasionally, rarely even get a chance to get out at breakeven.

I think I "get it" well enough so far but every time I have felt this way, some other aspect shows itself and its back to the drawing board. Sometimes is soooooo easy to see after the fact, but in the moment its wildly difficult. Clearly the easiest and most reliable setups are second entries with the trend, but you can add layers to that too. Trading reversals isnt an important thing for me, but understanding them is. If you dont know when or why to be thinking reversal, when and why to change bias or keep an open mind about it, how can anyone keep their probabilities high enough and consistent enough to make money?

Anyway im writing a novel here but I wanted to get these thoughts out for your feedback and direction. Not so much any direct question, more if my thoughts and observations are more "right" than they are "wrong" so I can stay on the right path. The attached charts are without trendlines etc from the day, but as the trading day goes on they get quite busy and noisy so ive been trying to workout the cleanest way to keep up with the important stuff without having a messy chart thats hard to follow.

[attachment=1]Screenshot 2023-09-29 222804.png[/attachment]

[attachment=0]Screenshot 2023-09-29 223026.png[/attachment]