- riskreward11.JPG (311.68 KiB) Viewed 2974 times

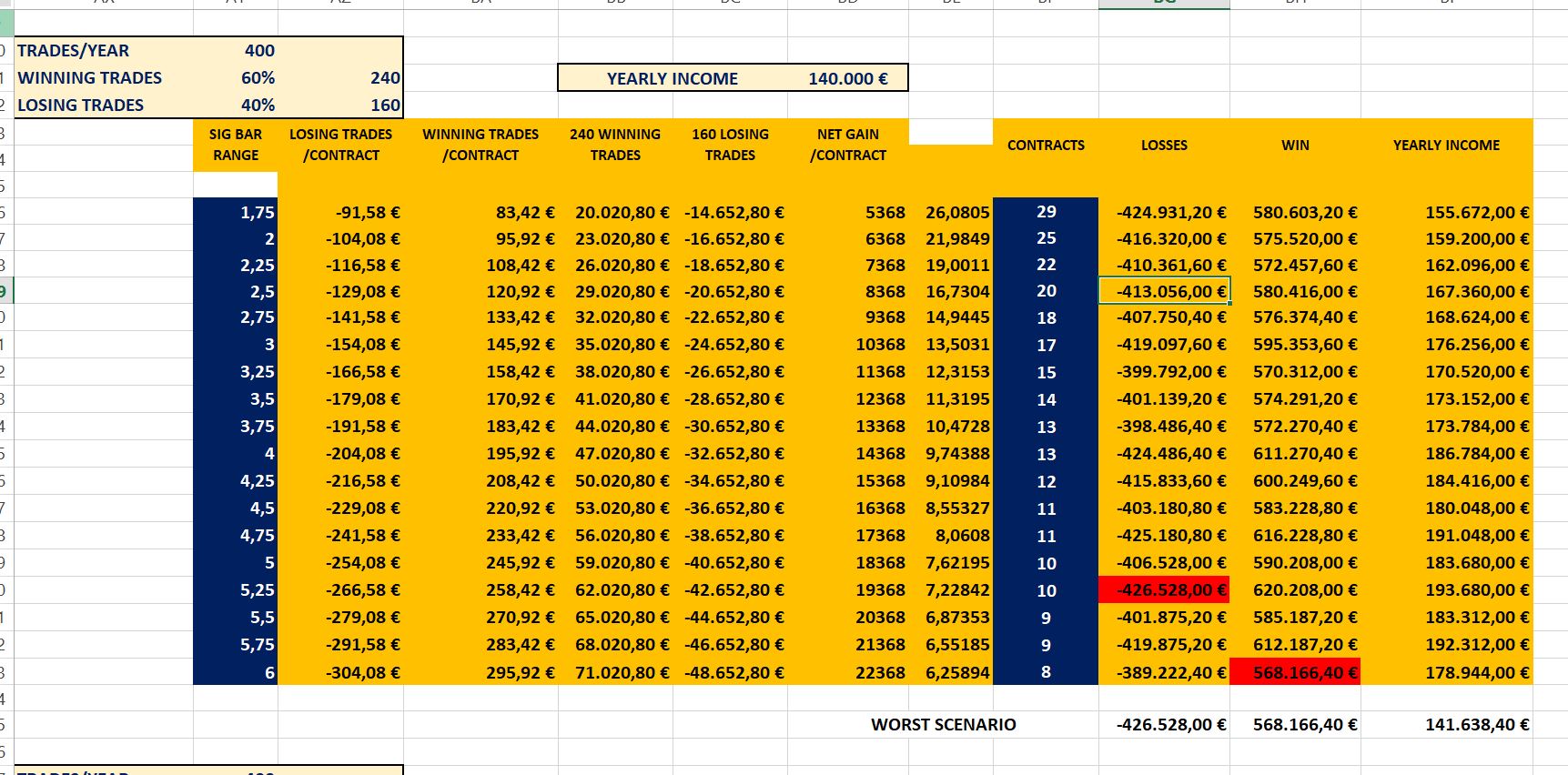

I just did some tests in excel for trade management.

Looking at last year, we can consider candlestick ranges between 2 and 6 points

My targets:

2 trades/day, 400 trades/year

Yearly goal after commissions: $140.000

The idea is:

Limit order 1 ticks better then real entry level (after breakout).

In long trade, limit order at high of signal bar after breakout

In short trade, limit order at low of signal bar after breakout

Stop loss as usual (1 tick above/below signal bar)

Risk:reward 1:1

(for example signal bar 12 ticks, target 12ticks, SL 12 ticks)

Commissions: 4.08/contract (ninjatrader account)

with 60% of winning trades we can reach our yearly goal varying number of contracts between 8 and 29 (see attached image).

Selecting just 2 trades/day (good signal bar, KEP, enough room in front of the trade, etc), 60% seems a reasonable percentage, even if i'll miss trades without 1-2 ticks retracement

$140.000 goal is reached even if all losing trades are 5.25 points trades and all winning trades are 6 points trades (worst scenario)

no trades with signal bar range <1,75 points and > 6 points.

I'd like to read your opinions

[attachment=0]riskreward11.JPG[/attachment]I just did some tests in excel for trade management.

Looking at last year, we can consider candlestick ranges between 2 and 6 points

My targets:

2 trades/day, 400 trades/year

Yearly goal after commissions: $140.000

The idea is:

Limit order 1 ticks better then real entry level (after breakout).

In long trade, limit order at high of signal bar after breakout

In short trade, limit order at low of signal bar after breakout

Stop loss as usual (1 tick above/below signal bar)

Risk:reward 1:1

(for example signal bar 12 ticks, target 12ticks, SL 12 ticks)

Commissions: 4.08/contract (ninjatrader account)

with 60% of winning trades we can reach our yearly goal varying number of contracts between 8 and 29 (see attached image).

Selecting just 2 trades/day (good signal bar, KEP, enough room in front of the trade, etc), 60% seems a reasonable percentage, even if i'll miss trades without 1-2 ticks retracement

$140.000 goal is reached even if all losing trades are 5.25 points trades and all winning trades are 6 points trades (worst scenario)

no trades with signal bar range <1,75 points and > 6 points.

I'd like to read your opinions